Get the free amazinggoodwilldonationreceipt form

Get, Create, Make and Sign

Editing amazinggoodwilldonationreceipt online

How to fill out amazinggoodwilldonationreceipt form

How to fill out amazinggoodwilldonationreceipt:

Who needs amazinggoodwilldonationreceipt:

Video instructions and help with filling out and completing amazinggoodwilldonationreceipt

Instructions and Help about amazinggoodwill donation receipt com form

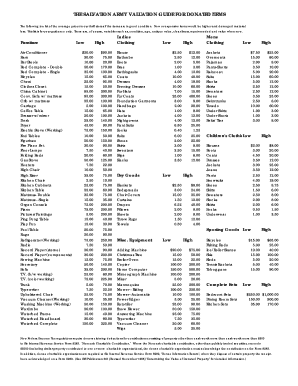

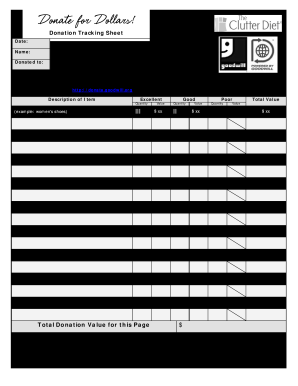

How do I idem eyes a donation to Goodwill a very good question most of you probably know that the charitable contributions that you make go right on your schedule a which is itemized deductions kind of right there in the middle of the form and let's go for if you give cash that's on that's one line of the form but if you give non-cash things like you contribute furniture or your old clothing or kids toys for example to Goodwill that is also included on Schedule A bit if you have more than $500 of non-cash contributions you got to attach another form and whoever thought that the IRS would want us to attach another form well we all thought that in fact but the fullness you're actually going to need is Form 8283 on the title of the form is non-cash charitable contributions and again the that when you need this form is if your total contributions to the Salvation Army to Goodwill to your church any of those that are in the in total or five hundred dollars or more than you're going to have to complete this form, and you can see here on the form that it's relatively easy the name of the organization that you gave the stuff to and then a description of the property there's a place down here to put the value of that property and most of that type of property is assumed to be donated at thrift store values so if you had a suit for example that you may have paid $200 for five years ago when you used to be really heavy now you're also self because you've been working out, and you donated that suit it's certainly not going to be worth the $200 that you paid for it so be real careful with the value that you allocate to that suit but using this form 8283 you can see it's relatively easy to fill out but if you end up with more than five hundred dollars fill out this form 8283 attach it right with your tax return the total from this form goes right on schedule a, and you'll reward with the deduction of course for your charitable giving, and it's certainly a great thing to do something and I know that's making them difference so keep that up I like

Fill https amazinggoodwilldonationreceipt com : Try Risk Free

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your amazinggoodwilldonationreceipt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.